NEWS | April 28, 2023

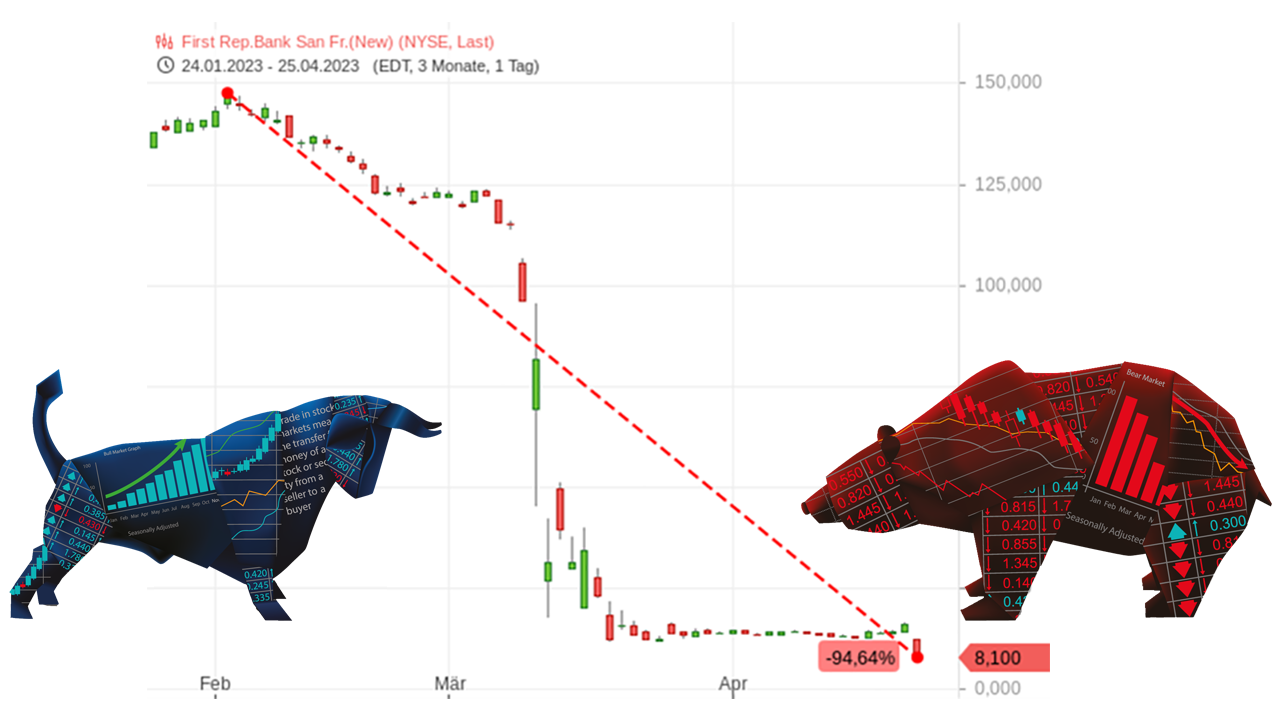

Banking Crisis Surrounding First Republic Bank Triggers Bearish Signals in Stock Market

Will it never end? Just when you think the banking crisis is behind us, the next source of concern emerges in San Francisco. The First Republic Bank, in its recent quarterly report, has reported an “unprecedented outflow of deposits.” While these deposits amounted to around $176 billion at the end of 2022, they had dwindled to only $104 billion by the end of March 2023. This included $30 billion stemming from an emergency action prompted by several major banks, including JP Morgan Chase.

Erosion of Customer Trust

The bank’s stock price promptly plummeted, dropping more than 40% last Tuesday. Overall, the stock has lost about 90% of its value since early March. First Republic Bank attempted to reassure by emphasizing that deposits had largely stabilized since the end of March. Simultaneously, the bank took on expensive loans, including from the U.S. Federal Reserve, to offset the dwindling deposits. The institution is currently planning a comprehensive cost-cutting program, aiming to eliminate 20 to 25% of all positions within the bank. What do such messages do to customer trust?

The events surrounding First Republic Bank are causing fear and unsettling the markets. The Regional Bank Index hit a new low. U.S. futures also displayed weakness on Wednesday, marking a new low despite after-hours increases in Alphabet and Microsoft stock prices. Furthermore, the breadth of the U.S. stock market sent a brief bearish signal when 86.5% of the total trading volume was attributed to stocks whose prices were declining.

“Bear Tamer” Commodities

In situations like these, some financial specialists recommend options or knockout certificates. But can these really protect against falling prices? We have something that, in our experience, works better: commodities, as they are true “bear tamers.” Particularly, the demand for technology metals and rare earths continues to rise as part of the energy transition, and market turbulence need not be feared. Owners of critical production metals, required for wind power and solar energy, can anticipate unique opportunities for attractive, tax-free returns.