NEWS | April 20, 2023

Are We on the Verge of Escalation?

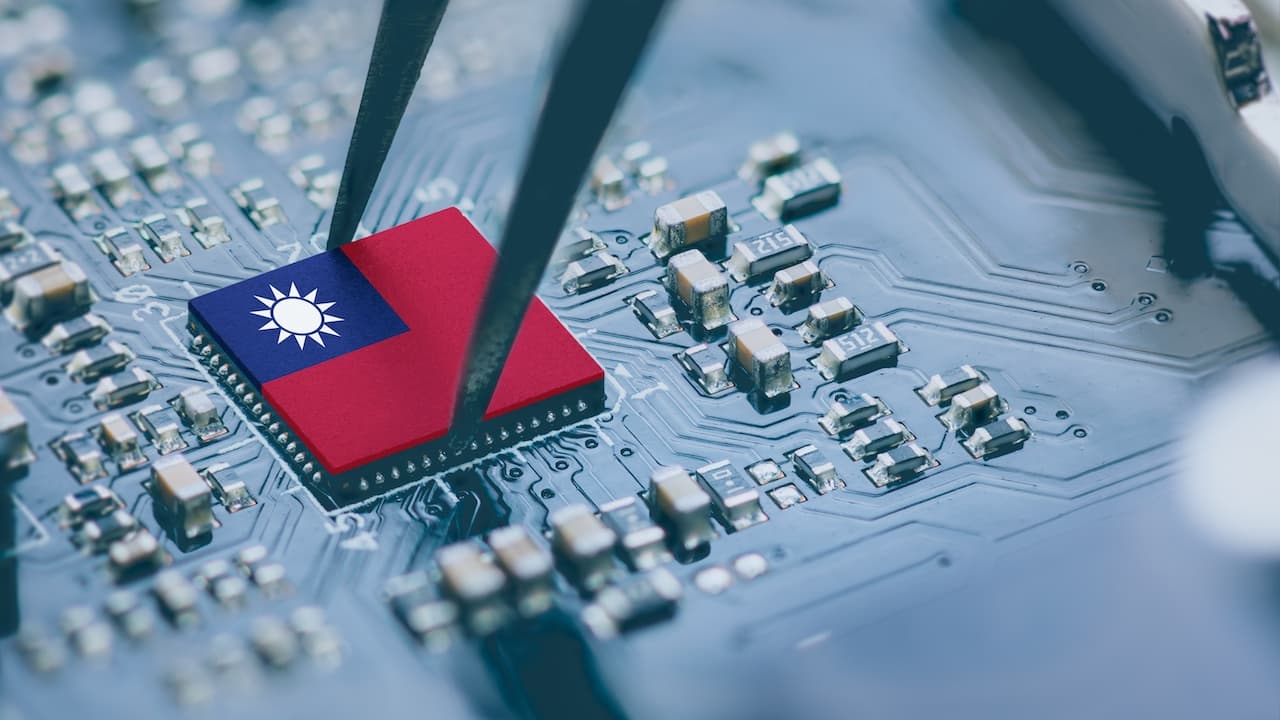

During Easter, reports emerged that China had crossed the unofficial border to Taiwan by sea and air. One reason for China’s increasingly assertive behavior might also be the supply restrictions on high-tech semiconductors imposed by the US in 2022 under the Biden administration. The embargo aims to technologically isolate China.

China Needs Taiwan’s Semiconductor Production

In contrast to China, Taiwan can produce semiconductor products using the latest technology. This is likely fueling China’s appetite for the island. The conflict is escalating – a situation that the US and the EU seemingly tolerate through their embargoes.

Halts on Intermediate Rare Earth Products

In general, it can be assumed that dependence on China for rare earths and their refined products will be broken in about 5 years. The Beijing government is aware of this. Therefore, the Politburo is imposing halts and tariffs, at least for now, not on the critical raw materials extracted from mines, but on processed products like wafers and solar technology. Yet, even this monopoly is likely not lasting. The EU is currently subsidizing the development of the latest technologies in various key industries with billions of euros. This makes Europe less dependent on China even for end products, gradually weakening China’s market power. Despite broken monopolies, demand is growing faster than supply. Price jumps of up to 30% are expected. Golden times could be ahead for investors, but they shouldn’t wait too long.

Warren Buffett Sells Shares in Taiwan Semiconductor Manufacturing

Legendary investor Warren Buffett has sold a significant portion of his shares in Taiwan Semiconductor Manufacturing. When asked why, he provides evasive answers. The Oracle of Omaha seems to have a bad feeling about it, though. Should we panic due to the Taiwan crisis? In our view, that wouldn’t help anyone. However, one thing Buffett is certainly right about is his rule “not to lose money.”

New Interview: How Private Investors Buy Technological Metals and Rare Earths

Those who buy technological metals and rare earths are prepared for all eventualities of the Taiwan crisis. Additionally, a physical investment protects against inflation and currency depreciation. In an interview for Wirtschaft TV, commodities expert and financial analyst Andreas Kroll explains how private customers can buy critical metals and which ones are currently most important:

Because security is crucial in physical investments, Andreas Kroll also explains to host Sascha Oliver Martin the advantages of a digital means of use control. With this, providers of critical metals offer their customers an unprecedented safeguard for their investments, setting a new standard in consumer protection.