A specter is haunting the internet. It haunts numerous financial websites in the form of the startling news that the BRICS countries, namely Brazil, Russia, India, China, and South Africa, intend to replace the dollar with their own currency. Depending on the source, this currency is backed by gold or other valuable metals such as silver and rare earths. According to the Russian propaganda channel RT, the new currency is supposed to be announced on August 22 in Johannesburg. Some wonder whether the news is just a rumor or if it could be true after all. In that case, the gold price would undoubtedly skyrocket.

Expert predicts tenfold increase in gold price and repricing of commodities

With a trade surplus of 950 billion dollars, as shown by the BRICS countries, their trading partners would need to acquire 16,000 tons of gold to be able to transact with a gold-backed currency in the future, according to business consultant and author Dr. Markus Krall. This would lead to a gold price up to 10 times higher and a repricing of many other commodities. Especially due to the explosively rising inflation in the West, many metals would become more expensive. Initial signs are already visible: After the news started spreading like wildfire since Monday, the gold price shot up the following day.

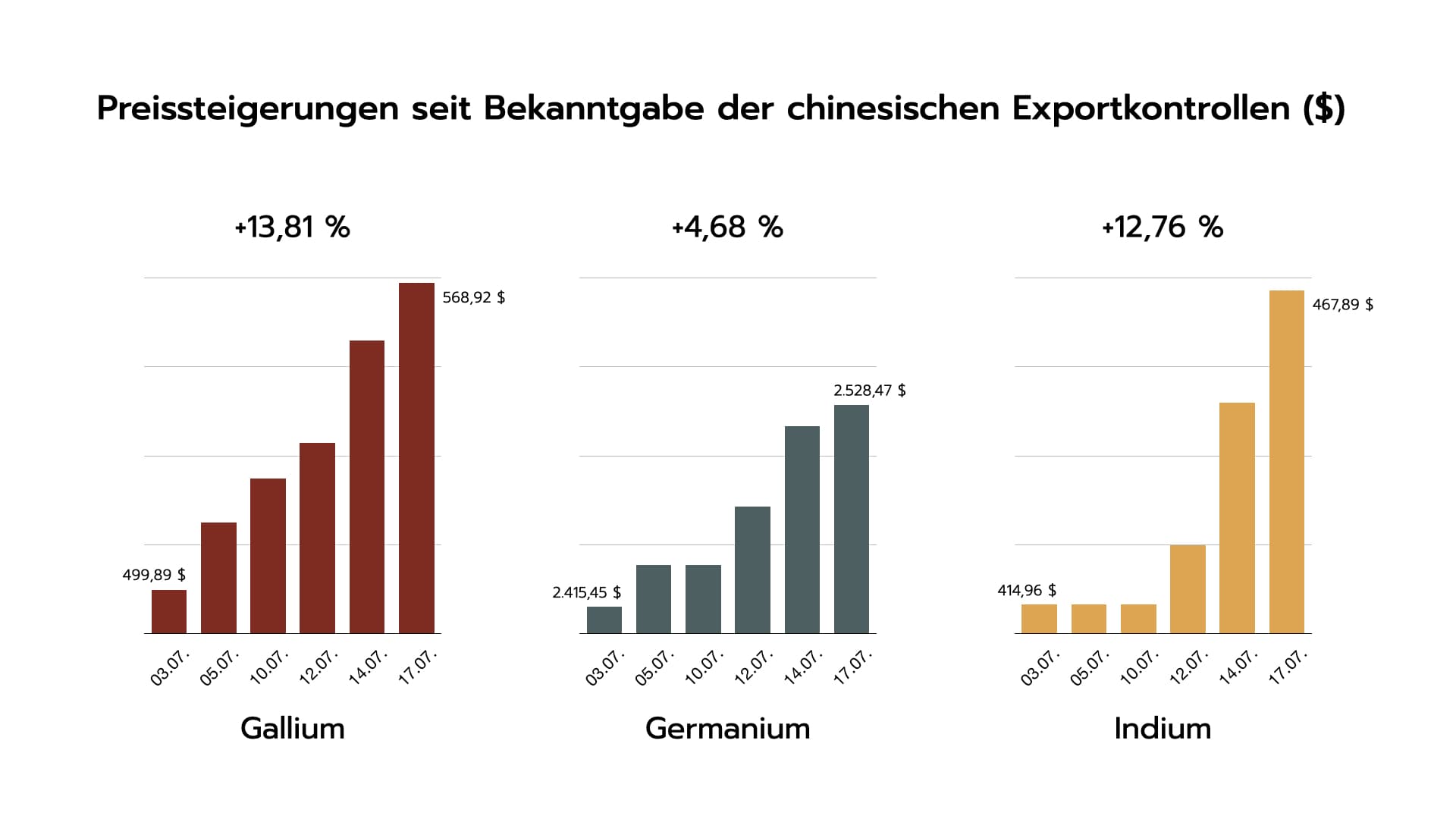

Chinese export stop leads to rising prices not only for germanium and gallium

In our quiz two weeks ago, we asked our followers how they assess the price development of gallium and germanium after China announced export controls. Today, we have the answer: Both metals have increased in price. With a growth of 4.68% from July 3, 2023, to July 17, 2023, the price of germanium has only slightly increased so far. This may still offer good opportunities for a repurchase before the rally REALLY takes off. On the other hand, the price of gallium has increased by 13.81% in this period, indicating a significant response to China’s announcement. So far, so predictable. Both germanium and gallium are essential for semiconductor development. No wonder the industry is now stockpiling supplies to be prepared for all eventualities.

Favorable waters for indium

What surprised us, however, is the price increase of indium. The value of the silvery technology metal increased by 12.76%. This growth far exceeds that of germanium, which is directly affected by export controls. Indium and gallium are chemically relatively similar and both are used in CIGS solar cells. Since China also plans to monitor exports of machines for solar cell production and has already targeted germanium and gallium as two solar raw materials, it is likely that indium is up next. “What you have, you have” is certainly the right motto in this situation.