NEWS | March 27, 2023

The Banking Crisis: Over or Still Simmering?

The Silicon Valley Bank has gone bankrupt, and Credit Suisse was forcibly merged. The share price of Deutsche Bank has stabilized today after significant losses, which looked quite different on Friday. Is the world back in order then? By no means, we believe. Because as interest rates rise, so do loan defaults.

For now, governments and central banks in the US and Europe are calming investors and traders with words and money. Especially the latter has been a popular panacea since the 2008 financial crisis. When deposits are at risk, liquidity is the only way to restore confidence.

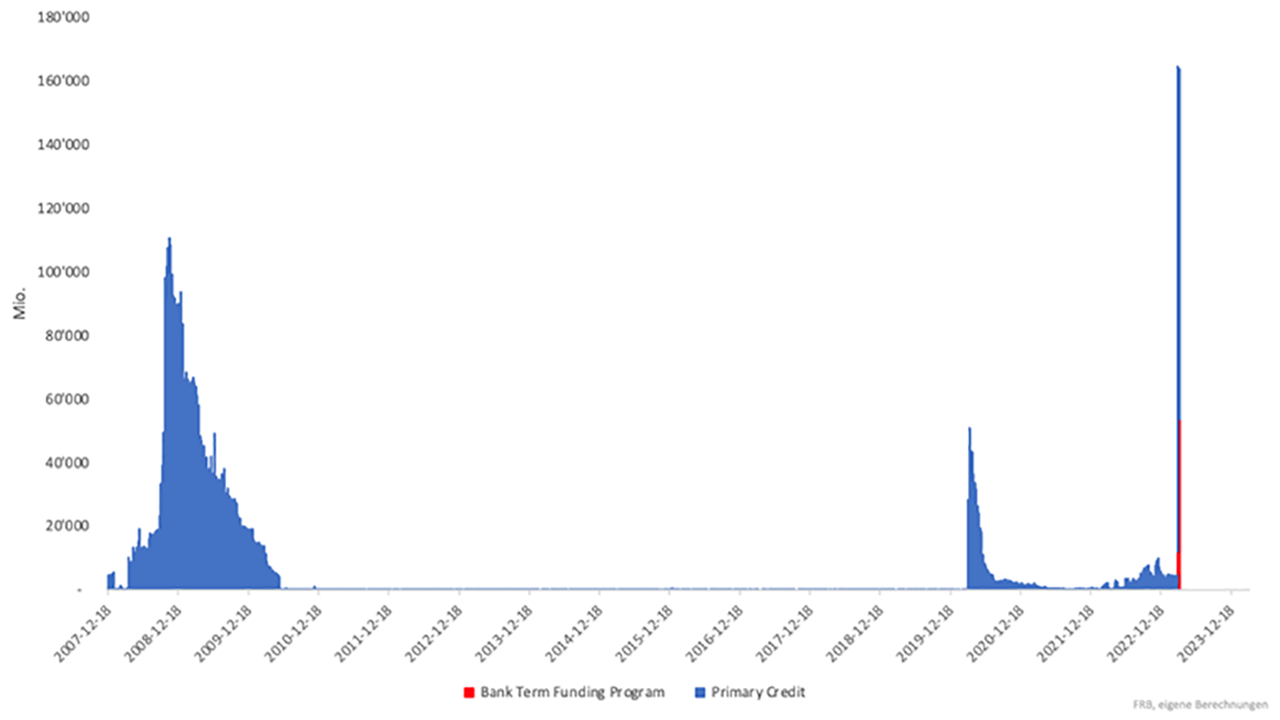

The chart below illustrates that comprehensive liquidity programs were implemented in 2008, during the COVID-19 lockdown in 2020, and also during the Silicon Valley Bank crisis. Does this have anything to do with the magnitude of the respective crises? One thing is clear, though – liquidity programs have never been rolled out on such a large scale and so quickly as they are now. The total amount has now reached a record $160 billion.

© stock3AG / Clemens Schmale

It might be that the biggest banking tremor has been calmed by recent measures. However, the entire system remains unstable. According to financial expert Sandra Navidi on wallstreet:online TV, there are currently 200 US banks at risk, as they are sitting on $2 trillion in unrealized losses. Additionally, there are unregulated shadow banks of various sizes in the US, whose lack of transparency can conceal further risks. Therefore, it’s essential to consider secure investment options.

You might have guessed it: A good way for investors to minimize financial market risks is commodities. Purchasing technology metals and rare earth elements involves a pure commodity transaction, avoiding the risks of stock market speculation. Furthermore, this approach offers the potential for attractive returns, including tax-free purchases and tax-free profits after one year of holding.