NEWS | May 3, 2023

Crises Can be the Breeding Ground for Rising Commodity Prices

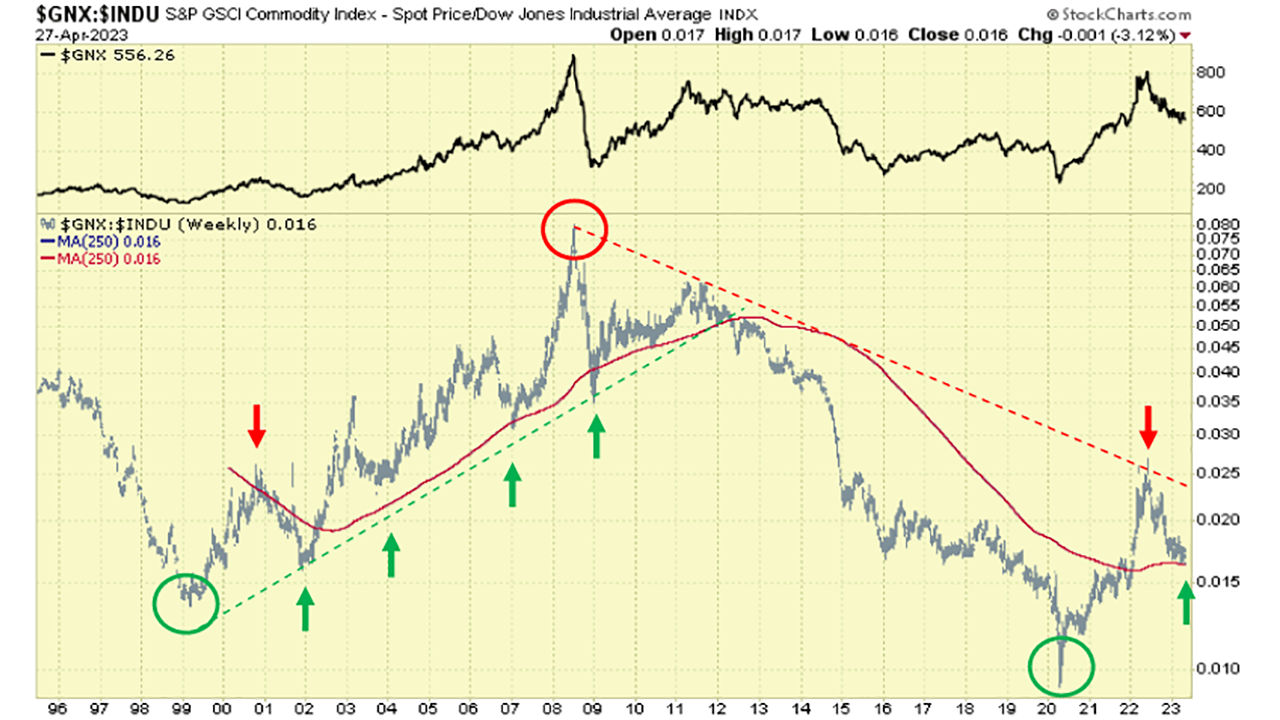

Commodity prices move in cycles. First, they fall over years, only to suddenly shoot up. But how can commodity investors know which part of such a cycle they are currently in? A look at the commodity index of the last decades shows that there are always the same signs before the start of a new cycle.

The price curve of physical metals shows so-called inter-market buy signals. These discontinuities, spanning about 100 years, begin in the 1930s with World War II and reappear thereafter on the occasion of certain significant events, up to the present day. During the time of the pandemic, there was a sharp drop in prices, followed by an almost hysterical surge after the outbreak of the Ukraine conflict. This is nothing new, as it had also happened at the beginning of previous cycles. In this context, it’s not surprising that prices initially decreased. This by no means indicates poor performance of commodities. On the contrary, commodities are undervalued and currently in a consolidation phase – the ideal time to buy.

In the past months, we faced a cyclical bear market. The war in Ukraine, along with the inevitable reconstruction that follows, will require a vast amount of commodities. What will follow is a true commodity bull market that is just beginning.

Rising inflation and an all-encompassing stock market bubble, all this closely resembles the situation in 2000. That time marked gradually rising commodity prices for the following decades. There were occasional corrective setbacks, but the growth trend was always clear.

In such times, investing in physical technology metals and rare earths is a good decision, as these critical metals always have utility. Electric cars, mobile phones, green energy supply, and the defense industry all require them. Those who want to buy now have the optimal opportunity, including the chance for attractive tax-free returns.