NEWS | June 8, 2023

Commodity Supercycle Expected to Yield Up to 900% Outperformance

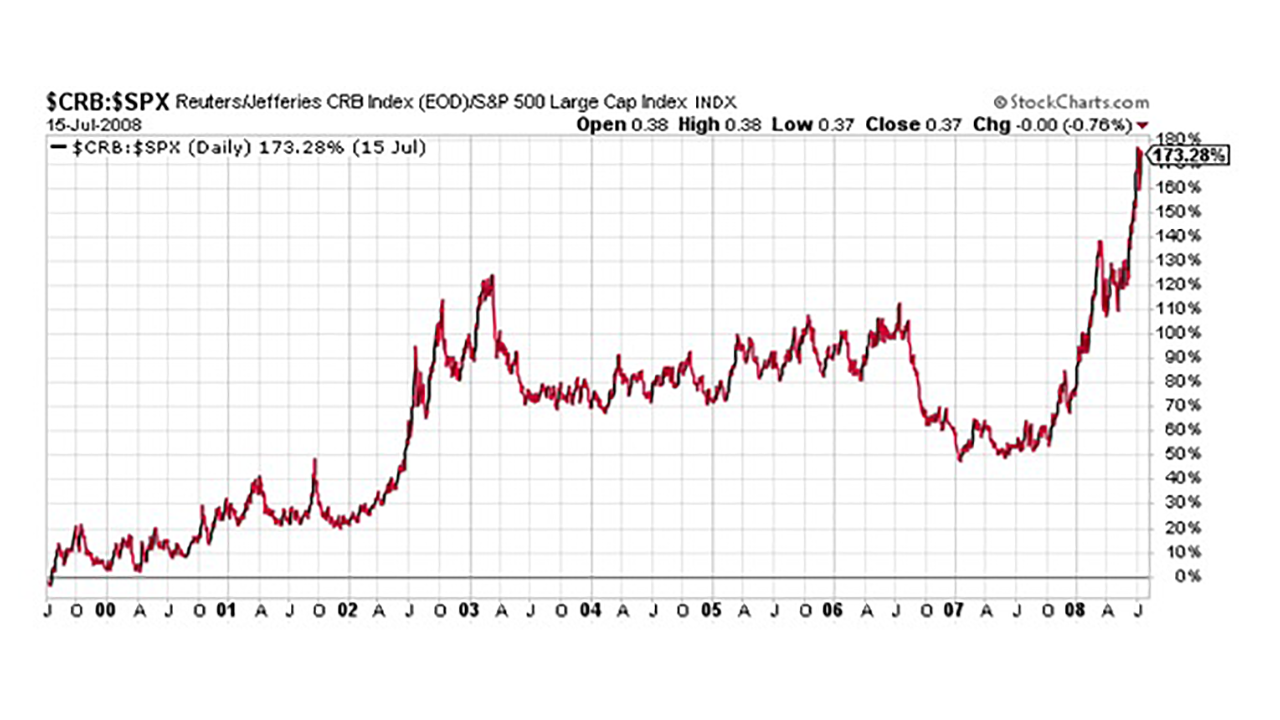

Caption: During the last inflationary commodity cycle, the commodity index CRB had repeatedly outperformed the stock index S&P 500.

The Investor Verlag, actively engaged in stock market affairs, foresees a sustained higher inflation as the basis for a new commodity supercycle. A decade characterized by consistent and sometimes even declining inflation has come to an end. Neither stock market prices nor bonds or real estate have yet responded to this shift. Due to consistently high P/E (Price-to-Earnings) ratios for these assets, some are already referring to it as the “Everything Bubble.” Not included in this are commodities, which enjoy promising prospects during times of high inflation.

The Investor Verlag arrives at its conclusion that high inflation is the foundation of a commodity bull cycle by comparing the events of past commodity cycles with today’s situation. Both in 1970 and during the period from 1999 to 2021, commodities managed to outperform the stock markets. For instance, the value of gold increased by 400% during the latter period, and that of oil even by 700%. In both periods, an inflationary market cycle supported the commodity markets.

The current commodity cycle began in 2000, triggered by the end of low inflation, expansive monetary policies, and supply chain issues. The COVID-19 pandemic temporarily slowed it down, but it is now gaining momentum again. Since the 2008 financial crisis, stocks have been overvalued compared to commodities. The P/E ratio of the S&P 500 is 22.2 points, the energy sector (oil and gas) is at 5.7, and commodities overall are at 11.3. Such substantially undervalued commodity assets indicate that a higher valuation of the sector is practically inevitable. While stocks are expected to decline, the Investor Verlag sees a potential commodity outperformance of 700% to 900%.

High inflation is born from high prices, especially in commodities. The best protection, therefore, is to invest in commodities as a cause of inflation. As the value of money diminishes, the value of commodities, especially those urgently needed by the industry, increases. Technological metals and rare earth elements are bottlenecks for many industries, making an investment offer the best protection, while also being tax-free.